Divorce Mortgage Tips

When a marriage ends, the division of assets, particularly the family home, can add an extra layer of complexity and emotional strain. Divorce can have a significant impact on a mortgage loan, potentially affecting the ownership of the property and the repayment of the loan.

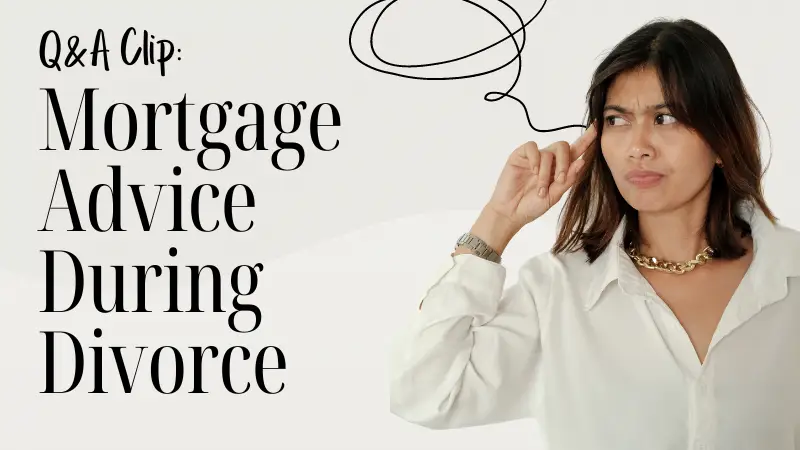

Scott Levin divorce mediation attorney and Sam Mehta from Blue Fire Mortgage Group share invaluable insight into navigating the treacherous waters of handling a mortgage during a divorce. The discussion focuses on maintaining financial stability and understanding the implications of joint mortgage responsibilities post-separation.

Home Divorce Options: Buyout, Sale or Co-ownership?

One of the most significant decisions to make during a divorce is what to do with the family home. In some cases, one spouse may choose to buy out the other and become the sole owner of the property. In this situation, the co-owner would need to be removed from the mortgage, and the sole owner would need to refinance the loan in their name. This process can involve significant financial scrutiny and may not be feasible if the remaining spouse cannot qualify for the mortgage on their own.

Alternatively, both spouses may choose to sell the home and divide the proceeds. How the funds are divided depends on if it is community property in whole or in part. Determining whether a home purchased before marriage is community property or separate property will have immense impact. When a sale is made, the mortgage would need to be paid off, and any remaining funds would be divided between the parties. Selling the home can be an emotionally challenging decision, but it may be the most straightforward way to resolve the issue without further complicating the divorce proceedings.

Navigating California Divorce: Mortgage Advice & Tips

One of the main points covered by Sam Mehta is the strategy of both parties remaining on the mortgage temporarily. This approach can be beneficial in certain circumstances, especially when refinancing is not a viable option due to high mortgage rates. Sam emphasizes the importance of crafting a detailed cohabitation or separation agreement that can clearly outline the responsibilities and terms for each party involved.

Both Spouses Stay on the Mortgage

A critical aspect that many may overlook is the impact on the departing spouse’s ability to qualify for a new mortgage. Sam clarifies that a consistent 12-month payment history by the remaining spouse can exclude the other from mortgage obligations on their credit report, marking the start of a new financial independence. However, this requires careful timing and documentation, starting from the date of the official separation or divorce agreement.

This episode is not just about navigating the technicalities of mortgage management during a divorce but also about approaching the situation with grace and financial savvy. Sam’s expert guidance through Blue Fire Mortgage Group ensures that individuals facing divorce have the support and knowledge they need to make informed decisions about their home loan responsibilities.

Navigating mortgages during a divorce can be a challenge, but with the right advice and support, it can be managed effectively. Sam Mehta’s expertise shines a light on the path to financial stability and independence for divorcing couples. The episode underscores the value of expert advice and the importance of understanding the nuances of mortgage management in the context of divorce. It’s a must-listen for anyone facing the daunting task of managing a mortgage after a breakup.

Refinance the Mortgage During Divorce

In some cases, it may be necessary to refinance the mortgage to remove one spouse from the loan. This can be a challenging process, and it’s crucial to have a clear understanding of the financial implications of refinancing. The remaining spouse will need to demonstrate their ability to manage the mortgage payments independently, which may involve providing evidence of income, creditworthiness, and stable employment.

San Diego Family Law Attorney: Home Loan Divorce Consultation

We can help during a free consultation identify other professionals you can speak with and give you advice about the process and information you should start to consider and understand. We want what is best for you and your children.

To get started on learning more about your options, call Scott Levin at 858-293-1410 or schedule an appointment online. Trust Scott Levin and San Diego Divorce Mediation and Family Law to handle your military divorce with confidence and peace of mind. Scott focuses his practice on crafting tailored agreements to resolve conflicts quickly and respectfully in divorcing couples.

Transcript:

Speaker 1:

Hey everyone, this is Scott Levin, chief Peacekeeper. I’m here with a good friend of mine, sam Mehta. How are you, sam? Good, scott, how are you doing Good?

Speaker 1:

So Sam is, with Blue Fire Mortgage Group, a really long-time professional in the mortgage refinance business. Sam, how long have you been in business? 21 years, oh, and since you’re 31 now that means you’re 10?. I tried 44, but sure, yeah, well, actually I got you beat by a year.

Speaker 1:

But so the reason I wanted Sam to come on and talk to us or with us for a few minutes is about, you know, obviously, given the mortgage rates and the mortgage climate that’s been in existence for a little while now, clients of mine going through divorce and divorce mediation in particular, where they’re trying to come up with a collaborative agreement and they’re willing to give and take and figure out solutions that allow, for example, one person to stay in the home and keep the home, but maybe they can’t get the other person off the mortgage right now because of the rates being too high. So, sam, off the mortgage right now because of the rates being too high. So, sam, if a couple and a family are considering like, look, we have these kids, we want them to live in this property with this person, but the loan element can’t be modified right now. Walk us through some of the things that they should be thinking about in terms of both parties staying on the loan and how that might change in the future and under what circumstances.

Speaker 2:

Sure. So that’s a frequently asked question that we get where borrowers are separating or are in the process of separating and they refinance during the ultra low rate environment of COVID. So they might have a mortgage that’s somewhere between 2% and 3% and mortgage rates are much higher now. So where their goal is is to basically figure out if they can keep their mortgage, keep the low rate and stay the path with both being on the loan and title or one party being taken off the loan. And technically it can’t really be done because mortgage loans are not assumable by nature. However, with the right mediation and cohabitation agreement or merit settlement agreement in place, it’s possible. That’s where we refer to people like you, scott, to help kind of navigate that, because that’s a frequently asked question.

Speaker 2:

Now, one of the things we tell borrowers is look, we understand a lot of times that they don’t want to refinance or they can’t qualify because rates are higher and it’s much more expensive. So a lot of times we tell them to refinance or stay the path where they’re at, get through their settlement and then revisit it in six months to a year after the settlement’s over. That way they have a little bit of breathing room and some time to figure it out. It still keeps, even with the settlement agreement in place and after everything is said and done it still keeps the divorced couple kind of joint at the hip, financially speaking. So ultimately it’s not sustainable in the long run. But it might help them to bridge the gap by buying some time and kicking the can down the road on it.

Speaker 1:

So one of the things that we talk about when, so when one person is who’s not going to like kind of be um in the house or part owner of the house anymore, but they’re on the loan, obviously their credit is tied to those payments. But one of the things that I often told, or what I often mention, is that if they wanted to buy something down the road themselves, is there not a way for this loan to not be considered for their mortgage capacity? So my understanding is that if the, if the, if the payer of the loan makes 12 consecutive monthly payments from a separate account, that this person who’s still on the loan, but if they go to qualify for a new loan, that that loan won’t be considered against their mortgage capacity. Is that? Is that a hundred percent of time? Is that?

Speaker 2:

accurate?

Speaker 2:

Yes, that that is completely correct.

Speaker 2:

So typically, if you do get where I think what you’re trying to say is is if a couple gets, goes through the separation process and then they’re officially divorced, yep, they still have the mortgage in their names, but one party is responsible for it, the other is not.

Speaker 2:

And it’s outlined in the marriage settlement agreement. Typically a 12 month history showing that the spouse that kept the house has been making the payments is usually sufficient. Now there is a possibility that they might reduce that to six months in the future, but that’s not really been solidified. So we tell all borrowers that just be prepared to show a 12 month pay history. So the downside with that where the departing spouse who’s leaving, to start it like, who’s leaving the property or signing off on the property to their, to the, to their, to the spouse, the ex spouse, that person is handicapped because they have to wait 12 months before they can qualify for a mortgage, which means they have to rent and and do that whole thing until they’re closer to that 12 month watermark where their ex spouse has made those payments consistently.

Speaker 1:

So that’s the only like drawback that we see what, if a couple has been like separated since like 2019 and they’ve kind of been already, or maybe that’s too long, that doesn’t always happen but like 2022. So it’s like almost three years, right, or going on three years. You know, party A is living in the house, they’re paying all the payments, party B has been out, they’re renting or whatever Is that, and let’s say, this person, the payer, has been paying those payments. Does that mean that 12 months has started back then, if they’ve been doing it from a 12 month, if they’ve been doing it from a separate account already, or does it start from, like, the signing of the settlement agreement or some other period?

Speaker 2:

That’s a great question. So it depends Now typically if the payments have been made consistently for 12 months. So let’s say they separated, the payments have been going on for 12 months and then they decide to go through mediation and do all that. Typically, if it’s already outlined, it usually goes from the file date. But if the separation agreement has the right verbiage in it to show that the last 12 months were accounted for, then usually there’s some flexibility. It’s a little bit of a gray area but we can work through that. So it’s really important to address that at the beginning of the mediation session with your respective or with the respective mortgage lender, who might be able to help navigate them. But it could. I’ve seen it go both ways, but it really falls back on the verbiage of the settlement agreement and the actual circumstances of when the file date was.

Speaker 2:

So, there’s changes constantly.

Speaker 1:

It could be possible that if the verbiage in the settlement agreement referenced that the parties had agreed that that 12 months started sometime in the past, could that override the fact that those 12 months were not from a separate account? Or do you need both, like if they still were paying the payments from a joint account but they had agreed that the money funding that joint account was really from the person who was living there? Could that be?

Speaker 2:

I think it can be If it shows that who’s accountable. But they have a shared bank account and then if the assets were split in that account and party A had enough to cover the payments and their expenses and then party B have their separate, then that’s fine. It just has to be really detailed in the settlement agreement. But yeah, it can be done that way. Typically what we usually see is one party moves in a situation like this. What’s a little bit more common is one party moves out and then they’re just kind of making the payments and then keeping some cash in the joint bank account so the ex spouse can pay. You know, their bills, joint bills like the utilities and other expenses, and credit cards, just to kind of buy.

Speaker 2:

So that’s typically what I’m used to seeing. But the bank account, to my knowledge, hasn’t really surfaced. But once again, I think if it’s buttoned up correctly in the settlement agreement, then your mortgage lender should be able to play well with given circumstances.

Speaker 1:

So lots of issues going on with mortgages and refis and also coming out of a, maybe even coming out of a, going on with, you know, mortgages and and and refis, and and also coming out of a, maybe even coming out of a sale and like, what should you think about in terms of, you know, getting your next mortgage? Is there one piece of advice that obviously most of the people watching this and that are following me are are are kind of plugged into the divorce process or entering it or maybe in the middle of it. Are there any? Is there one overriding kind of challenge that you find the people calling you are in and how they could avoid those things? Is there kind of one piece of advice you can leave people with?

Speaker 2:

I think the key thing is is we are huge proponents of mediation. Key thing is is we are huge proponents of mediation. So as long as there, if it’s cordial enough, we always recommend that they talk to a mediator first and, you know, determine what is doable and what isn’t. That’s usually the first you know order, like the first precedent that we always kind of push towards.

Speaker 2:

Now, that being said, not all mediators are created equal. So, for example, some understand the importance of getting the real estate piece settled between the two spouses and then maybe there’s further negotiations between retirement accounts or other financial assets and they’re not sure that’s okay. But as long as the mediator is savvy enough to figure out their real estate piece, that’s usually the biggest financial entanglement between both parties. So we always say start from there first, as long as there’s like a house in the mix. Now, if they don’t own a house, I don’t think it matters as much, in the sense that their financial footprint is probably much simpler. So where this like webinar or this discussion really comes in, where it becomes really pivotal, is when there is real estate owned. So that’s the biggest, I think, differentiator and that’s where a lot of things get complicated because there are some tax questions around investing. You know the tax deductions and write-offs and then mediation, and not all three along with the mortgage, and not all three play fair with each other at all points in time.

Speaker 2:

So, you know, just having the right parties to kind of help navigate through is really key, especially.

Speaker 1:

I agree with you. I agree with you. I agree with you and when people want to talk about you know that, are working with me. You know issues beyond the house, it all. We always have to get the house figured out first, but everything else comes from the house, especially if there’s equity or significant equity right, because all the other things are like you know trade-offs and what, but like who’s gonna does one of you on one on the house is? The other things are like you know trade-offs and what, but like who’s going to does one of you own one on the house? Is the other? Is there going to be a sale? Is there going to be co-ownership? Like that has to be addressed, and then the other pieces kind of fall into place.

Speaker 1:

Sam has helped so many people that I that are, that are so many of my clients and network in and out of the divorce world. I can’t tell you I’m not I’m certainly not the biggest referrer to Sam, but I mean he’s batting a thousand percent in responsiveness, education, willingness to share knowledge, time, responsiveness. I mean everything that you would want in someone in his position. When you need answers, he is literally delivered to anyone that I’ve ever referred. I encourage you to reach out to him. Sam, I’m going to put in your information. Is there like one place that you want people? Do you want people to go online? How can they easily reach out?

Speaker 2:

No, they can check out. You know they can reach out on our website at bluefiremortgagecom. We’re on Instagram at Blue Fire Mortgage. You can also email me at Sam at Blue Fire Mortgage if you have any questions.

Speaker 1:

And known as the best email newsletter in the game, I think too, Every Friday there’s thousands of people that look for that email newsletter.

Speaker 2:

All right, sam, I’ll talk to you soon. Thank you very much, scott, for putting this together. I appreciate all your help. Thank, you.